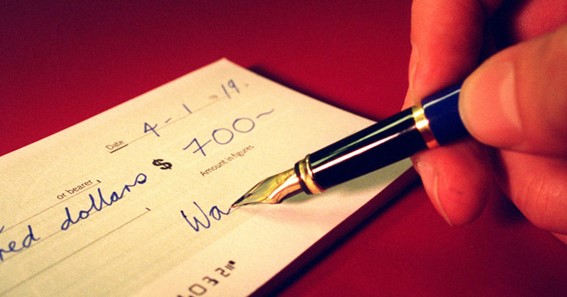

People who issue checks regularly will find the process practically automatic. However, if you haven’t written many statements before, this can be perplexing. Electronic transfers are being replaced by comments, although they are not yet obsolete. Here are the procedures for filling out a cheque to self and explaining the numbers preprinted on each one.

Date

Fill in the date on the check’s blank line in the top right corner. The month/day/year arrangement is widely used in the United States. This is significant because it tells the bank when you made the check and if it is postdated, which means it should be cashed on or after the date of the review.

Name of the recipient

Fill in the blank line after the phrase “Pay to the Order Of” with the recipient’s name. This can be an individual or a business—whoever receives the check. When referring to an individual, use both the first and last name, and when referring to an organization or company, use the entire term.

Quantity (numerical form)

Fill in the amount in the box to the right of the recipient’s name. To avoid someone putting in a new amount, write the amount as close to the left-hand side of the check as feasible.

Quantity (expanded word form). On the blank line below the recipient’s name, write the dollar amount in extended word form. On the other hand, Cents should be put in fraction form and in small letters to ensure that the entire amount can be typed down because this is the legally recognized amount on the check you make.

Signature

In the line at the corner at the bottom right of the cheque, sign your name. Your signature is required; else, the recipient will be unable to cash the check. Before you hand it over, double-check that you have written out your signature.

click here – 7 Major Factors that Affect Your Credit Score

Keeping Your Checkbook in Order

You can utilize the check register in your checkbook to write a check, spend cash, or deposit money into your checking account. This part of your checkbook is designed to keep track of your financial transactions, such as ATM withdrawals, online transactions, debit card payments, and check writing. You can observe how much money is coming in and going out of your account by writing it down.

Particular Considerations

When you encash a check made out to you, you must endorse it, which means you must sign the back of the bill on the proper line and add the date. Most banks include a few blank lines and a mark to indicate where the check should be signed. If you do not sign in the proper area, the statement may be invalidated.

click here – Choosing the Best Hair Oil according to your hair type

In conclusion

While the option to pay online from a checking account has significantly eliminated the necessity for physical checks, there are still instances when one is required, so knowing how to fill it out correctly is critical. Furthermore, learning how to create, endorse, and deposit a check is essential for early financial education. These were the steps to writing a cheque. To know more about cost centre, click here.