A Completely Guideline to Get Quick Cash by Payday Same Day Loans

Payday same day loans can be a life-saver when you’re in financial distress. However, not many people know how to apply for the loan and receive instant approval. With hundreds of lenders out there, it can be overwhelming to know which lender to work with, and that’s what this article will cover.

Ahead, you will learn what same day payday loans are, what you can use the loan for, the eligibility requirements for your application to be approved, and how to apply for the loan with guaranteed approval.

Let’s get started.

What Is a Same Day Payday Loan?

Same day payday loans are short-term unsecured loans that lenders or traditional financial institutions offer to borrowers and they pay back the loan on their next payday check. As the name suggests, same day payday loans are usually approved on the same day that you submit your loan application. They are designed for those who need emergency cash support to enable them settle pressing financial issues.

Click here – The Best Golf Belts for Any Budget: Which One Will You Choose?

What Can a Same Day Payday Loan Be Used For?

There are so many things you can use the same day payday loan for without getting into the bad books of online lenders and credit bureaus. Generally, most of the online lenders will approve your loan request if you need the loan for emergency medical expenses, urgent automobile maintenance, animal health care expenses, funeral costs, overdue utility bills, and mortgage or rental payments. What’s more? If you need a loan to enable you to facilitate the process of vacating abroad, you can also apply for a same day payday loan.

What Are The Requirements For Online Same Day Loans?

Lenders in the United States require that borrowers meet certain threshold or requirements before their loan applications are approved. If you are in need of a same day payday loan, some of the requirements that you need to fulfill before your loan request can be approved are:

- You must be a US citizen and must be at least 18 years old as of the time of the loan application.

- You must have a stable source of income.

- You must have a valid means of identification.

- Your bank account must be active and valid to receive funds from lenders.

- You must also have a valid email address and mobile number for easy communication.

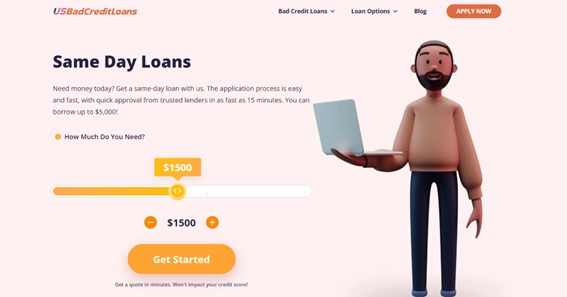

You can click here to learn more about same day loans by US Bad Credit Loans >>>

How To Get Quick Cash by Payday Same Day Loans

The process of obtaining a quick cash by payday same day loan can be cumbersome if you don’t know where or how to get started. US Bad Credit Loans is a loan broker you can trust to help you facilitate the loan application process. It does this by connecting you to 60+ lenders within the US.

The process of applying for payday same day loans on US Bad Credit Loans is seamless and straightforward. Find below how to take out same day payday loans:

Step 1: Complete a loan application form

The first step in the loan application process is to submit or complete a loan application form for a same day payday loan. You will need to visit the US Bad Credit Loans website, and enter your genuine information in the application form. Ensure your information is real and verifiable; otherwise, a lender might reject your application if they find that you submitted fake details.

Click here – Is Free License Plate Search Legal And How Does It Help Car Owners?

Step 2: Choose a loan offer

The next step is to choose a loan offer that suits your budget and repayment plans. After submitting your loan application, US Bad Credit Loans will pair you with a number of credible and trustworthy lenders that will offer you different loan options. It’s your responsibility to compare the offer to choose an option that you are comfortable with.

Step 3: Review the loan terms and sign the dotted lines

Once you’ve selected a loan option, the next step is to review the loan terms thoroughly and then sign the dotted lines if you’re comfortable with the terms and conditions governing the loan option that you have chosen.

Step 4: Receive funds in your account

This is the last step in the loan application process. After signing the dotted lines and submitting your loan application, the lender will credit your checking account with the amount that you have requested. The good thing about a same day payday loan is that the money will be available in your checking account on the same day that you submitted your loan application.

Conclusion

Online lenders provide same day payday loans to help individuals and families settle pressing financial issues. Whether you need money to pay for emergency medical bills or you want to renovate your old apartment, you can take out same day payday loans to achieve your aim. And when you are looking for a loan broker to work with, look no further than US Bad Credit Loans. This broker is very flexible and will pair you with credible and reliable direct lenders that will offer you same day payday loans with competitive interest rates and flexible repayment methods. Additionally, unlike other loan brokers, US Bad Credit Loans doesn’t charge a fee to process your loan application.

Frequently asked questions

Can I really get the cash on the same day?

Of course, you can get the cash on the same day of your loan application, provided you meet all of the requirements as stated by the lender and you have a good credit score. Before you choose an offer ensure you review the loan terms properly so as not to pay so much in fees.

How much can I get for a same-day payday loan?

The amount you can obtain as a same day payday loan largely depends on your income level and your credit score. Generally, most online lenders in the US can lend you up to $1,000 without depositing collateral for the sum.

What will the lenders look at?

There are so many things that online lenders consider before approving your request for a same day payday loan. Some of the requirements include your credit history, your salary or income level, as well as your state of residence. If you meet all of the requirements that a lender states on their website,.the lender will approve your request for a same day payday loan.